Regulators Gone Wild

For those that think municipalities’ main financial accountability should be to the people who pay for municipal services, the absorption of administrative capacity to report on provincial programs is alarming.

Here’s how the 350 provincial reports required per year break down by requisitioning Ministry and program.

3. Ontario Case Study - 3.1. Provincial Design & Local Response

How does the provincial design of municipal institutions play out in local communities, on Council, and to what end?

The article finds that local responses to weak design contribute to sub-optimal financial results.

Come Clean: Taking a Look at How Far the Provincial Hand is in the Municipal Pocket

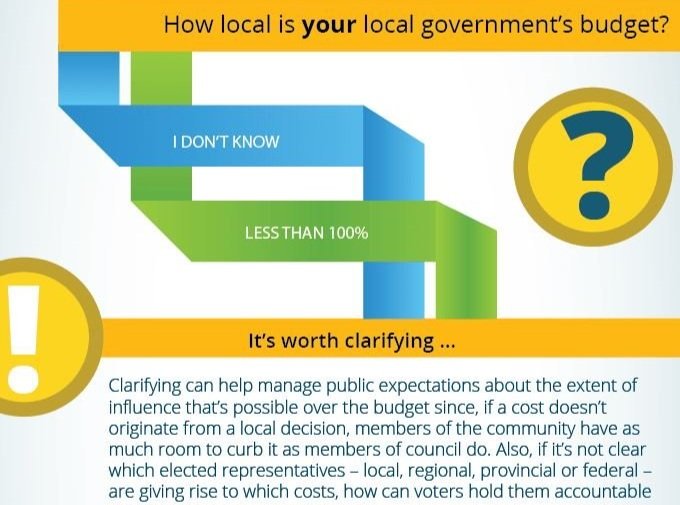

We often hear that local governments in Canada get just 9 cents of every tax dollar. But how much of that is even a council’s to spend?

One study found that just 9% of a municipality’s annual operating spend flowed from council decisions.*

How local is your local government’s budget?

Four Budget Visuals to Help You Tell Your Story

Infrastructure ownership changes and challenges.

Discrepancies between Council’s verbal and financial commitments to capital projects.

Rate-setting and levy presentation refinement.

How to demonstrate the value of municipal services so that residents get an hourly reminder from their own body.

Municipalities: Resume or Rebuild?

Normal. After health and safety concerns, the most common crisis impulse is to get back to ‘the way it was.’ Including professionally. Let’s distinguish, however between continuing to do something the way you’ve always done it and reverting to it after a break in the status quo.

For treasurers looking to go beyond patching the gaps in policy and procedure exposed by the disruption and re-consider some of the fundamentals whose logic produced the gaps, we have a request for you too: Keep reading.